EasyLiving’s Executive Director, Alex Chamberlain, was recently interviewed for Seniorcare.com’s Aging Misconceptions piece. Aging experts expressed the wide gap they see in the realities of eldercare versus perceptions and preparedness.

EasyLiving’s Executive Director, Alex Chamberlain, was recently interviewed for Seniorcare.com’s Aging Misconceptions piece. Aging experts expressed the wide gap they see in the realities of eldercare versus perceptions and preparedness.

Fortunately, with the range of choices available today, families can get the support they need. We hope Alex’s thoughts and tips offer a “senior care reality check” that will benefit your family.

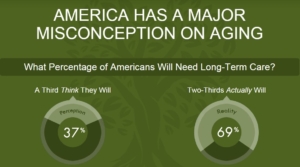

Why is there a drastic difference in people’s perceptions about aging vs reality?

No one likes to think that their body or mind will deteriorate over time. It not just an individual issue of denial, it is our health care system as a whole. We begin training our minds from a very young age that we are healthy and okay; only when “something” happens do we go see a doctor.

There is now a shift toward preventative medicine as more people (and our system) realizes this flaw. Yet, when it comes to aging or chronic care needs, everyone thinks they will be ok or that they have family to take care of them. Without having prior experience with it, perception will always be different than reality.

What are the consequences of these aging misconceptions and not being prepared?

Unfortunately as an owner of a home health business, I have seen the good, the bad, and the ugly. I have seen families’ quality of life disappear due to being unprepared for the challenges of long-term care. I have seen loved ones and family members never speak to one another again because they weren’t prepared and began fighting over everything. This can range from one sibling taking on the burden of care and feeling resentful of other siblings (and/or the non-caregiver siblings becoming angry over decisions or perceived influence of the caregiver) to fights over money and healthcare decisions. When families have fewer options due to lack of preparation and financial constraints, it just makes conflict and hard choices more likely.

I have also seen clients’ wishes not being met, because a lack of planning took away their options. By being in denial, we unfortunately don’t prevent things from happening; we just prevent our ability to have much or any control. On the flip side, I have seen it done right many times. There is no one right way to provide care, but the families who navigate the challenges successfully did their homework, got help from quality professionals, and availed themselves of the choices that were best for them.

How would you close the discrepancy gap?

I personally believe that the Baby Boomer generation will blaze the trail. Boomers have been perfectly fine with outsourcing and planning and I believe they will set the standards (and make all the mistakes) that future generations will learn from. With the growth of the internet and social media these subjects are getting more press and being shared with friends (stories usually mean more to people than stats). Because of demographics, many Boomers and their children have experienced long-term care’s effects up close and personal, so they know the downside of not being prepared.

Large corporations are adding “care management” services to their HR benefits because they are seeing the toll it takes on their employees with lost productivity and stress. As a society we are becoming more proactive with our healthcare. Technology has paved the way to make getting information and help easier than before. This will continue to close the discrepancy gap.

I think it’s also useful to reshape the discussion. For many people, the best motivation is to focus on doing this for your family. Yes, you may never need it, but just like buying life insurance, you do it as a gift to your loved ones so you don’t leave them in a difficult situation.

What advice do you have for consumers about their future care needs?

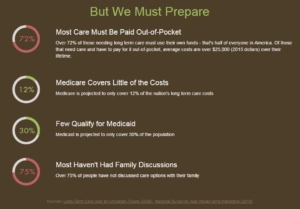

Think about what you want as you age and then learn a little bit about the realities versus your aging misconceptions. Sure, you always want to live in your own home, but what will you do when you can’t take care of it anymore? What will it cost you to get help? Do you want your daughter bathing and toileting you? Can a family member give up a job and their own retirement savings to do this? What does Medicare provide? What do retirement facilities cost? You can do research on the web to get some background, but ideally take the time to meet with professionals to ask questions about possible aging misconceptions and get personalized advice.

Our care managers have begun engaging more people proactively through our care consultations where we talk through future planning. Sometimes this is done in conjunction with their trusted advisor, like a financial planner or estate planning attorney. Together, the professionals can be especially effective in creating plans that cover your bases. If you understand the value of planning with your financial advisor or attorney, care planning should be given the same priority.

Americans have more choices than ever when it comes to aging care, as this piece points out: 86% of people will use an informal caregiver, 61% will use home health care and 19% will use assisted living, while 51% will use a nursing home at some point.

You can sign up for our monthly newsletter to get a jump start on understanding the realities of eldercare (and as an added bonus, when you do, we’ll send you a free copy of our Comprehensive Aging Wisely Checklist). The checklist has a Preparing Ahead section which also covers practical tips like organizing your paperwork and medical history.

I’d highly recommend taking the time to meet with a professional who can give you an overall picture, as it applies to your situation. It can save a lot of wasted time, and cut through any aging misconceptions you or your family might hold.